PAN & Aadhar Link : A penalty of Rs 1000 per head has to be paid for PAN-Aadhaar link. There has been a lot of dissatisfaction among our people. The central government is adamant even as the opposition political parties demand that the fine order be withdrawn. Rather, Union Finance Minister Nirmala Sitharaman on Thursday argued in favor of the fine. Aadhaar-PAN linkage is free till 31 March 2022.

A fine of Rs 500 has been added from April 1. Later, from July 1, it was increased to 1000 rupees. The deadline for PAN-Aadhaar linking was till March 31, but it has been extended to June 30. Along with that, the fine of 1000 rupees is also maintained. On this day, Nirmala said in a press conference that the government has given as much time as possible. Everyone should link PAN-Aadhaar as soon as possible. If the deadline is exceeded, the penalty amount will increase further.

Click here for User Manual of PAN & Aadhar : https://www.incometax.gov.in/iec/foportal/help/how-to-link-aadhaar

In fact, a statement released by the Union Finance Ministry on March 28 said that everyone should link PAN-Aadhaar or else face problems in TDS and TCS. Taxpayers who do not link PAN-Aadhaar by June 31 will have their PAN deactivated from July 1.Notably, various types of subsidies and social welfare schemes are paid directly to the bank. That is why it is important for everyone to have a bank account, starting from students to senior members of the family. Most of these beneficiaries are poor and marginalized.

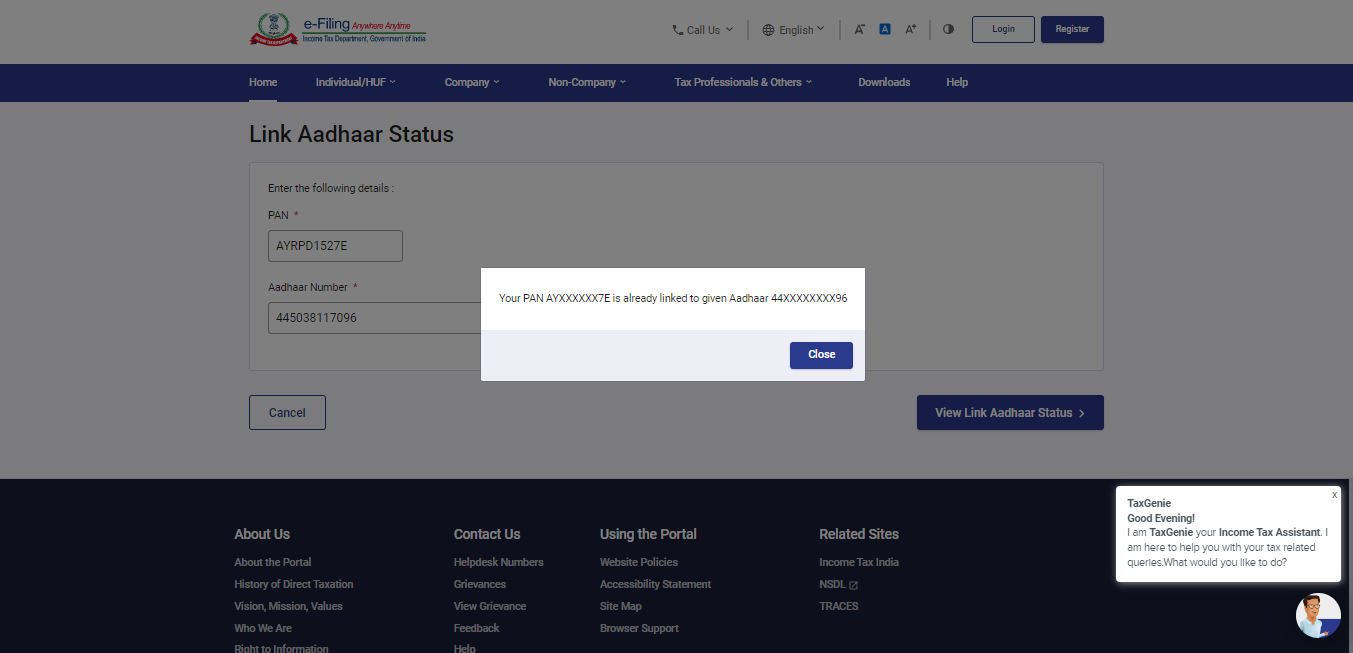

Click here for Link PAN & Aadhar : https://eportal.incometax.gov.in/iec/foservices/#/pre-login/bl-link-aadhaar

Notably, various types of subsidies and social welfare schemes are paid directly to the bank. That is why it is important for everyone to have a bank account, starting from students to senior members of the family. Most of these beneficiaries are poor and marginalized.

Click here for Check Status of Link PAN & Aadhar : https://eportal.incometax.gov.in/iec/foservices/#/pre-login/link-aadhaar-status